skip to main |

skip to sidebar

Basics of Financial Independence: Paying off debts

2. Pay off any debts you have. Start with the highest interest debts and work down until all is paid off.

- The second thing one should do on the road to financial independence is pay off all high interest debt obligations. Of course that begs the question, "What is high?" For simplicity, let's define "high" as anything 1 point higher than the current 30-year fixed mortgage rate (currently 4% so "high" would be 5%+). I think that should be easy enough.

- Now that you have identified all your "high" interest debts, you should begin aggressively paying them off starting from the highest interest debt working downwards. Now of course you make minimum payments to all with the extra funds going towards the highest interest obligation until that is paid off, rinse-repeat. It also doesn't hurt to look into refinancing/consolidating these debt obligations under better rates when available. Often times a simple call can save mucho dinero.

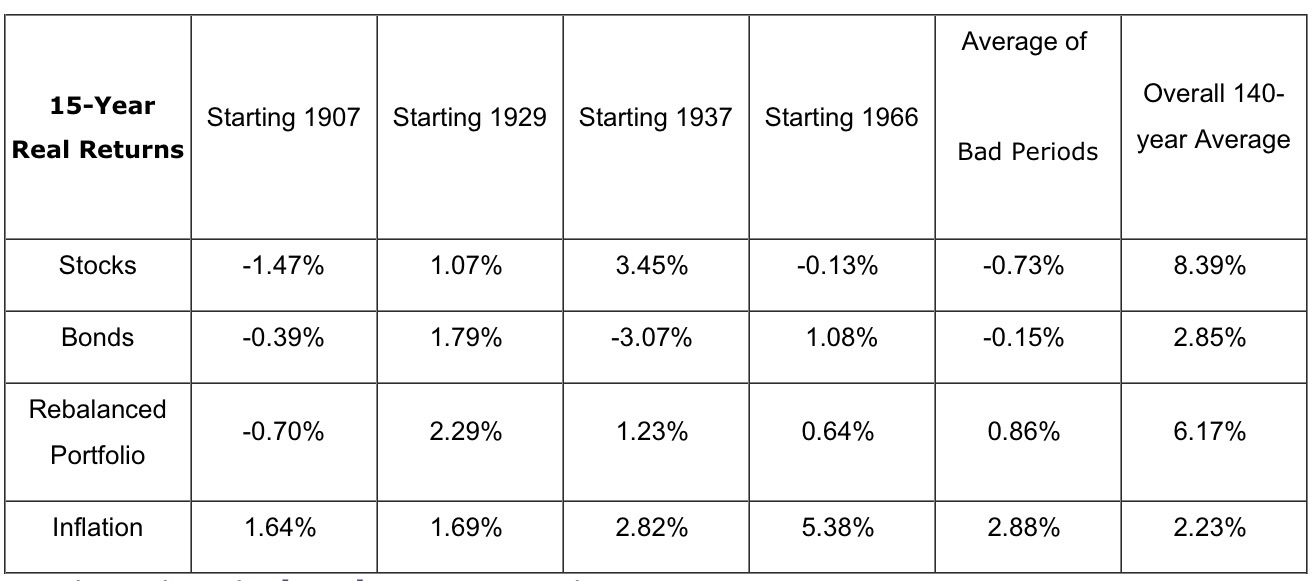

- Now that you're left with NOT "high" interest debts, what should you do? You can ratchet down a notch or three on "aggressively paying them off" but you definitely want to pay MORE than the minimum required payments. Remember, this is the "basics of financial independence" not the "basics of getting rich via leverage." I know this can be a challenge for someone who has a car loan fixed at 2% and/or a mortgage fixed at 3.5% while the stock market (S&P 500) has double-digit returns over the last X years, but keep in mind there are also 1, 5, 10 and 15 year periods where even a 50/50 balanced portfolio has lost or made very little money (see chart below for 15 year real return periods). In conclusion, while your debt obligations are fixed who knows what the next X years of market returns will look like?

No comments:

Post a Comment