- The first step is to find out your current spending rate. The usage of a free app such as Personal Capital may prove very helpful in this arena. Once you have all the data of where your money is going you should try to align it with your goals (travel, photography, etc). Spending that isn't aligned with your goals is where you should be doing your significant cuts (Ex: junk food when you are trying to get into shape). I have found that this review alone is usually sufficient to get folks on the path to success.

- Do not negate the savings achieved through discounts or cost cutting on ongoing items such as cellphone plans, cable bills, car insurance, childcare, commuting, etc. Some of these can be achieved via shopping around or via group affiliations (employer, alumni, professional organization, etc). Depending on your tax bracket and the state you reside in every dollar saved on these items can be as high as ~$1.50 in wages. As you can see, with some diligence this can translate into yearly savings of thousands of dollars in wages.

- Finding ways (side gigs, promotions, etc) to earn more money is just as important. Maybe that travel you love to do can turn into a travel blog that you can use to generate ad revenue. Maybe that job opening above you is something for which you should apply. The point is you are only bounded by your imagination when it comes to additional sources of income. For example, I know a few engineers who make a lot of side money in real estate investing (both rental income and house flipping).

- And last but not least get the most out of your employer via pension/401K contributions, HSA contributions, employee stock purchase plans that provide a built-in discount and tuition reimbursements for education/training that will improve your earning potential. This can be the most lucrative (Hint: some are tax FREE) and yet it is often the most overlooked.

Monday, July 13, 2015

The Basics of Financial Independence: Maximize your savings rate

3. Maximize your savings rate.

Thursday, June 4, 2015

Basics of Financial Independence: Paying off debts

2. Pay off any debts you have. Start with the highest interest debts and work down until all is paid off.

- The second thing one should do on the road to financial independence is pay off all high interest debt obligations. Of course that begs the question, "What is high?" For simplicity, let's define "high" as anything 1 point higher than the current 30-year fixed mortgage rate (currently 4% so "high" would be 5%+). I think that should be easy enough.

- Now that you have identified all your "high" interest debts, you should begin aggressively paying them off starting from the highest interest debt working downwards. Now of course you make minimum payments to all with the extra funds going towards the highest interest obligation until that is paid off, rinse-repeat. It also doesn't hurt to look into refinancing/consolidating these debt obligations under better rates when available. Often times a simple call can save mucho dinero.

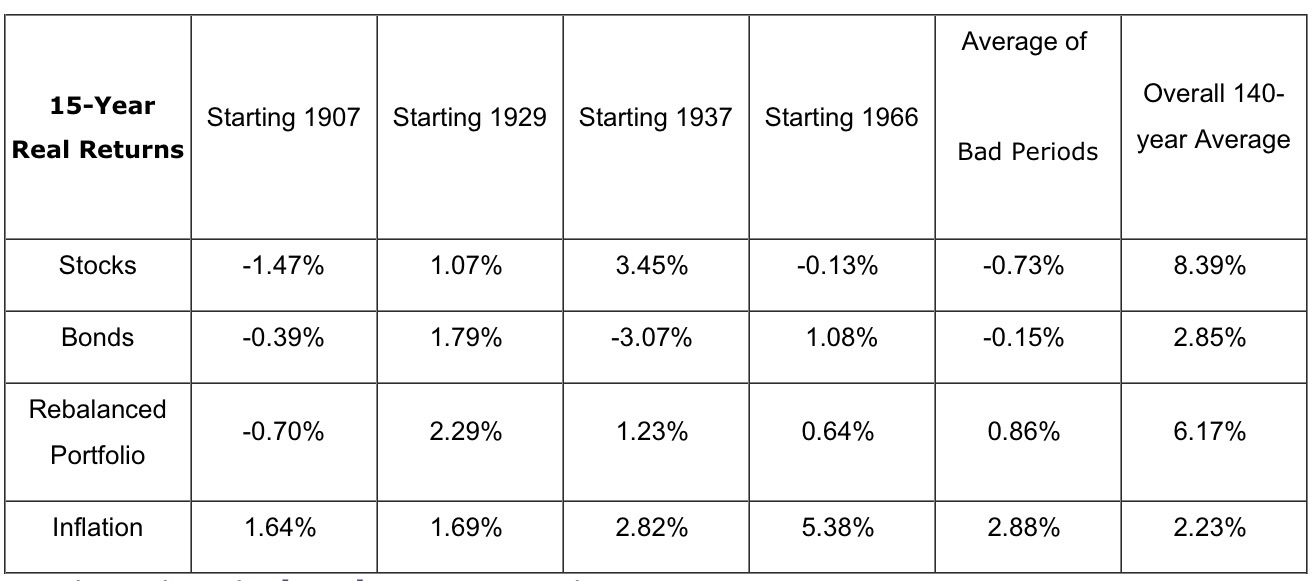

- Now that you're left with NOT "high" interest debts, what should you do? You can ratchet down a notch or three on "aggressively paying them off" but you definitely want to pay MORE than the minimum required payments. Remember, this is the "basics of financial independence" not the "basics of getting rich via leverage." I know this can be a challenge for someone who has a car loan fixed at 2% and/or a mortgage fixed at 3.5% while the stock market (S&P 500) has double-digit returns over the last X years, but keep in mind there are also 1, 5, 10 and 15 year periods where even a 50/50 balanced portfolio has lost or made very little money (see chart below for 15 year real return periods). In conclusion, while your debt obligations are fixed who knows what the next X years of market returns will look like?

|

Labels:

bankruptcy,

emotional discipline,

Finance,

goals,

investing,

student loans,

subprime mortgages,

wealth

Tuesday, June 2, 2015

Basics of Financial Independence: Emergency Fund

1. Set aside 6-12 months of expenses in a savings account as a rainy day fund.

- The very first thing one should do on the road to financial independence is set aside an emergency fund. And the first step in this process is finding out your average monthly expenses. This can be accomplished the easy way by using an expense tracker such as Personal Capital or by manually adding them (housing, utilities, food, etc) up using pencil and paper. Either way, this step shouldn't prove that difficult.

- The next step would be to find a savings account that offers you some return on your money since the best case scenario is that this money will never be used. Deposit Accounts is a useful website that can assist you in finding a high interest bearing personal savings account that suits your needs. Personally, I am biased towards credit unions such as Alliant Credit Union but you are free to find one that best suits your individual needs.

- So is it 6 or 12 months of expenses? Personally, I recommend having 12 months of expenses set aside just because of the peace of mind it buys. For example, with only 6 months of expenses saved the average person will start panicking after 4 months of being unemployed. This can lead to rash decisions being made. One way to have the best of both worlds is to first set aside 6 months of expenses, complete the remaining 4 steps towards financial freedom, then circle back and increase the emergency fund to 12 months of expenses.

Friday, May 29, 2015

The Basics of Financial Independence

This list is actually in order starting with the most important item first:

- Set aside 6-12 months of expenses in a savings account as a rainy day fund.

- Pay off any debts you have. Start with the highest interest debts and work down until all is paid off.

- Maximize your savings rate. I recommend starting with spending less since there you have the most control but finding ways (side gigs, promotions, etc) to earn more is just as important. Another angle on this is getting the most out of your employer via pension/401K contributions, tuition reimbursements for education/training that will improve your earning potential, corporate discounts on existing bills (cellphone plans, childcare, etc).

- Invest in a low-cost (as low as humanly possible, aim for < 0.20%), tax-efficient (bonds in tax advantaged accounts such as IRAs/HSAs/401Ks), diversified (Total Bond, Total US, Total Int'l OR a Target Date fund to save all the stress), balanced (for your time horizon, 80-20 is a great starting point) index portfolio.

- Time...let it marinate. The sooner you get done with #1 (you can weather storms), #2 (you are debt free), #3 (you have grown your earnings AND/OR lowered your expenses so you are investing more), and #4 (your investments are growing with very little headwinds from fees and taxes) the quicker you can be financially independent.

And the above list is such that if you just get the first 1, or first 2, or first 3 done, you are better off for it. Don't look at it as a all or none to prevent you from starting. Best of luck.

Labels:

goals,

investing,

retirement,

tax shelter,

Vanguard,

wealth

Subscribe to:

Posts (Atom)